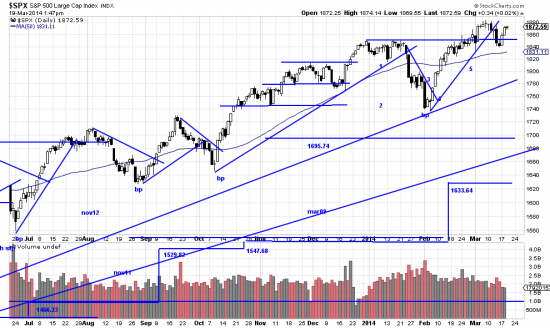

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p83750808625&a=214966864

While the trendline at 5 is broken its consequence is minimal — a 25 day upwave just notable for making a new high and drawing the attention of contrarians who remain always ready to pounce. It should be noted however that their unceasing attempts to drive the market down are actually making the market stronger. What we would have to worry about would be a runaway wave that left the market overbought (as many pundits say the present market is). These are all really opinions, and worth as much as their proponents are making off them in the market. Accumulating profits are the best antidote to their nostrums. (Please don’t say nyah-nyah-nyah. Taunting draws penalties).

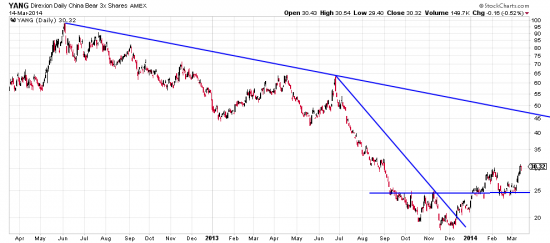

And if they are right that China is going to implode we might as well make some money off it. Herewith YANG. The obverse ETF for the China index (leveraged). We bought some today . The long downtrend that is broken here is the mirror image of the positive effects for some time of the China index.

http://stockcharts.com/h-sc/ui?s=YANG&p=D&yr=2&mn=0&dy=0&id=p83982672168&a=342121228

A close up look:

http://stockcharts.com/h-sc/ui?s=YANG&p=D&yr=0&mn=6&dy=0&id=p15251550098&a=342124837

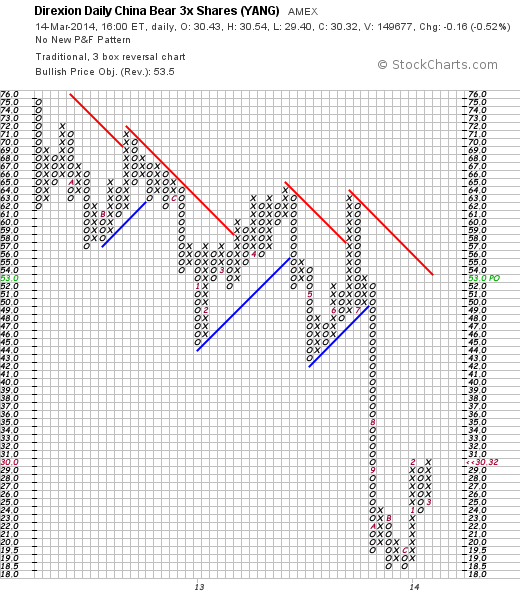

The stop at 26.48 is identified. For what it’s worth the PnF chart has an optimistic target for this trade:

(no link) Target 53.

ANNOUNCEMENTS OF INTEREST (to us at least):

We will be returning to GGU to teach our graduate seminar FI498s starting in May going to August (more or less). The seminar can be taken as an auditor (cheaper than credit). If we say so ourselves (modestly) the course has been one of the highest ranked courses in the University. And as one seminarian remarked it was always fun and a joy to attend.

Separately, five of our books are available in paperback at amazon.com: StairStops; Signals; Ten Trading Lessons; Zen Simple: Beat the Market with a Ruler; and Sacred Chickens, the Holy Grail and Dow Theory.