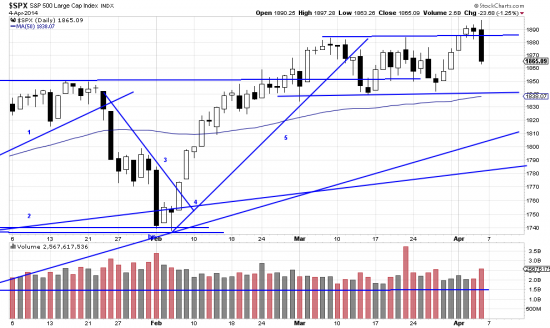

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=3&dy=0&id=p96206718625&a=214966864

First let us be clear. Giving inordinate priority to one day’s action militates against our long term intentions. But — oy vey — what a day. Yesterday the sky fell on chicken little. A 1.26% day in the S&P should be commented on for freak value if nothing else, and when your portfolio was hit by falling chickens (as ours was) you at least like to commiserate with fellow victims.

We warned a short time ago that contrarians retained immense influence in the present markets. Yesterday that was amply shown. There are two techniques regarding penetration to new highs. Our method, generally, is to buy new high breakouts. There are contrarian traders who sell new high breakouts, looking for a mean reversion short term scalp — and if you look at thousands of charts you see a frequent pattern of a pull back after a breakout (new high or not). In fact we know systems which observe new highs and deliberately wait for the pull back. This avoids many false breakouts and causes acid indigestion when the market just blasts off without the pull back. We usually deal with this phenomenon by scaling in to the issue. A small unit on the breakout, a second larger unit when the pull back proves to be just a pull back and then we scale in other units if the trend is productive.

There is so much top chatter that we don’t think we’re there yet. And our analysis says that the power bar yesterday is not in the right place to be the start of a landslide (or sky-falling). Beside the fact that the day’s volume, while moderately high, was not signal volume. We have already seen much larger volume in this formation. As of this minute we are regarding it as a return to the formation bar. As our readers know we change analyses as quickly as Ellen DeGeneris changes clothes on Oscar night. So it will really be a week or so before the full meaning of the day is seen.

More hammering would put us in a hedging mood.