http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=10&dy=0&id=p24745056520&a=214966864

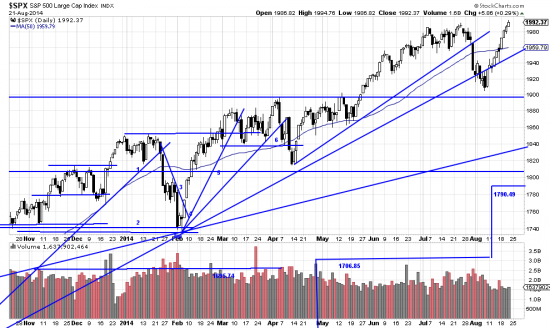

Some traders and investors are phobic about buying new highs, but best technical practice says just go ahead and do it. Hesitators point out the fact that breakouts are always sold and fall back and this is often true. But not always. Our practice has been to buy the breakout and then buy the pullback, scaling in. Today we increased our SPX position. We are almost back to the size we had before the correction. Above shows the raising of the Basing Point stop (1790.49), based on the new higher wave low at 5.

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p83257770514&a=266398464

A closer look shows that the penetration of the nov12 trendlne was a false alarm and we have erased the Rule of Seven targets. It seems very little damage was done, considering the trendlines. (The depth of the formation predicted (?) the extent of the correction). We can only attribute it to the underlying power of this bull market. Note that simple chart reading and the Magee Basing Points Procedure would have kept you long since mar09, Wall Street windbags (and Robert Shiller) (and Hindenburg Omens and top TRIN and A/D indicators and MarketWatch blather), to the contrary notwithstanding. We will, depending on conditions, be adding on next week.

We have figured out how to deal with the Shiller indicator. When we call our broker we are careful to specify that he buy our stocks at Shiller CAPE adjusted prices. We also told him to call Alice and tell her that the white rabbit is at our house enjoying a kale salad.