http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p22775897357&a=266398464

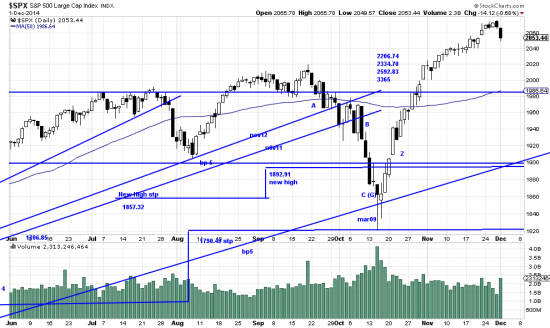

According to those who work overtime trying to find the secret of the markets (in this case seasonals) we’re supposed to enjoy a Santa Claus rally here. As always we look at the chart and say is this what is really happening? Bah humbug!

What is true is that we are 33 days into the recovery wave from the sell-off of October. Prices are clearly curving over, but, in fact, there is no trendline to be drawn here, as there is no pullback on which to anchor the line. News traders and nervous investors hammered the market today, and of course a 14 point move gets the attention. We did a little hedging, but we actually think the October down wave satisfied the market’s need for flushing. And the market remains nervous and fidgety.

There is some room for speculation about what is going on here — namely the progressively longer and stronger waves –27 days, 14 days, and then 18 days down and now 33 days surging up. What makes traders nervous is (or was) 32 days without a significant down wavelet. Traders start thinking “overbought” and start edging toward the musical chairs, at the saame time paying heed to the bullish forecasts being bruited about by the talking heads. We have previously remarked on our skepticism that what we are seeing here is a broadening pattern. But we do think that some flushing is in order. The long time stops are still on, since the October downwave can’t be used to set new stops.

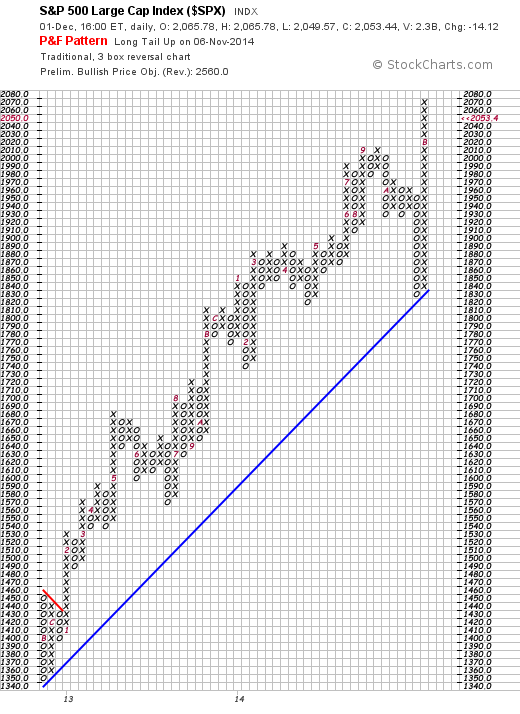

The PnF chart is enthusiastic about SPX prospects:

(no link see stockcharts.com)

Bullish objective 2560. The last two columns strike us as unusual. Something big is probably in the offing. All the technical signs are bullish.

On other issues gold appears to have woken from the dead:

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=378710907

We actually think this is a trade and probably not a longtime one, but who knows what lurks in the hearts of gold bugs. As you can see there are many trendlines to be overcome. Nonetheless we are long.

Just as we are short the euro:

http://stockcharts.com/h-sc/ui?s=FXE&p=D&yr=1&mn=0&dy=0&id=p33634513359&a=340345374

The euro is pretty much getting what it had coming from the austerity policies of the EU, and it probably has more to come.

Giving Tuesday. Piled on top of Thanksgiving Thursday and Black Friday and Cyber Monday and Small Business Saturday and (spare us anything else) but Giving Tuesday does deserve attention. As we have previously noted, at Thanksgiving and Xmas we contribute to the Food Bank. We urge you to do the same.

God bless us all Mr Scrooge.