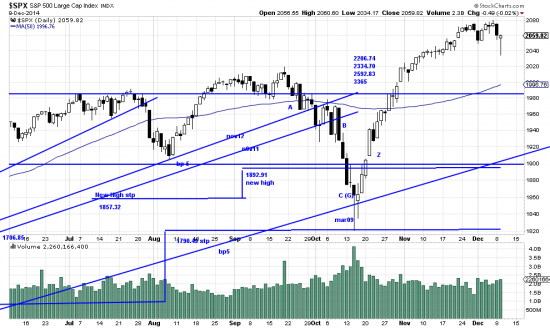

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p22775897357&a=266398464

It is a sobering, but not unusual, fact that Standard & Poors has caclulated that only 10% of funds are above water. One wonders why investors pay incompetent managers for substandard performance. We think it is investor fear. They are acutely aware that the purpose of the market is to transfer their capital to Wall Street so they hide out in funds, or as it were in to the trap.

Today was a day calculated to scare them into peeing their pants. The roundtrip in the SPX was about 50 points or so.

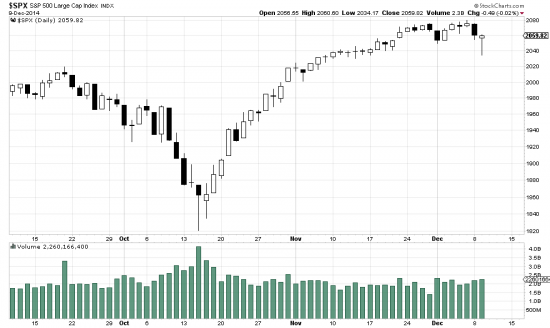

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=3&dy=0&id=p98868188097

If you know anything about candlestick notation (you should–Candlestick Charting Explained –Morris) the bar explains it all. Prices fell out of bed on the opening and did a bungee jump of minus 26 points then spent the rest of the day clawing back to finish a hair up. A dramatic day. Dramatic enough to put us in the mood of adding on. As always this is the aggressive and speculative posture. The conservative trade is to wait for the latest high to be taken out, but depending on the smell of the market over the next day or so we will be adding on. Our analysis is that if the market didn’t fall apart that it has got some of the anxiety out of its system. At a moment of maximum vulnerability the bears failed to break the market. Also the day is, by our analysis, a reversal day.