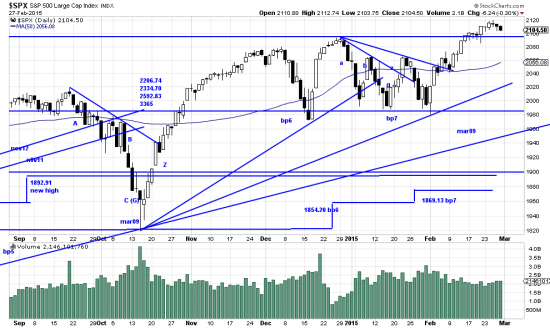

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p09524411098&a=266398464

Last letter we referenced the PnF charts for the major indices, which are uniformly very optimistic. At the moment we are barely out of the muck, but we are out of it so the time is good to recognize the essential strength of the market and the near/intermediate term prospects. This is not a wholly popular point of view. Especially among chicken fanciers who are still keeping a close eye on the sky. But the progress of the market is inexorable. And we fully recognize that, inevitable or not, the market will (as J.P. Morgan noted) fluctuate. In fact we are only 19 trading days in this wave, as opposed to 39 in the wave which terminated in (as the Irish like to say) the recent troubles.

We duly note and register the character of these markets — violent and volatile and unruly. We will live with it and buckle up when necessary. But our posture now is on the bold side and positive rather than defensive, as it has been for some time. Recently we pointed out GVAL as a wild card for a portfolio, as well as the Qs. Another of these issues is the bio-techs, represented by the ETF IBB.

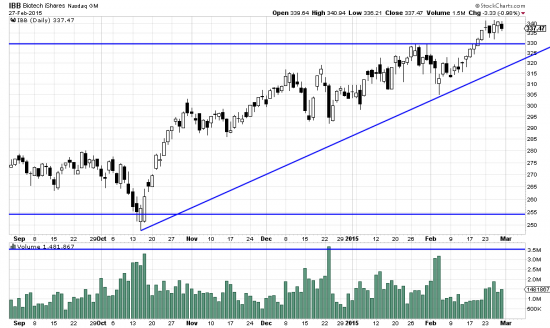

http://stockcharts.com/h-sc/ui?s=IBB&p=D&yr=0&mn=6&dy=0&id=p79433991532&a=340346015

Unless in a wildly speculative mood we woulld not buy bio-tech stocks. You wake up one morning with trouble with these individual stocks, but within the haven of an ETF we can handle the risk. We’ll be into this issue this week for our personal accounts.