http://stockcharts.com/h-sc/ui?s=%24INDU&p=D&yr=0&mn=7&dy=0&id=p51053375451&a=417742260

With the market vulnerable Thursday the contrarians changed the game. From selling strength and buying weakness they changed their tactics and went for the jugular, piling into shorts. They were quickly joined by the HFT, hedge funds and institutional day traders. These guys know an opportunity when they see one. The results are bloody to see. -500+ points in the Dow.

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p76542086636&a=266398464

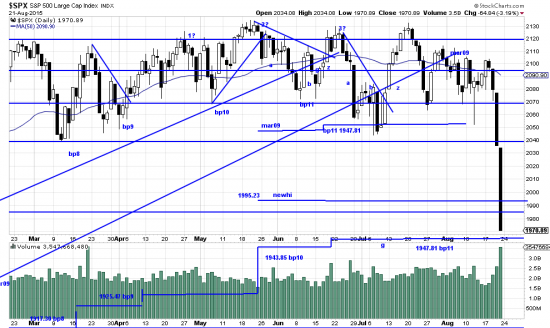

65 points, mas o menos, in the SPX.

Our immediate reaction was: Did we do enough to prepare our readers for this nasty event? We thrashed around through our archives and concluded that we had indeed done a professional job of analyzing a difficult sideways market. You can thrash around in the archives yourself, or just look at your email folder full of our letters growing progressively more pessimistic about the market. As a short cut, here are some letter links if post mortems are of interest to you:

http://www.edwards-magee.com/?p=5472

http://www.edwards-magee.com/?p=5368

http://www.edwards-magee.com/?p=5386

There are a dozen of these letters, if not dozens. Including that letter in May where we suggested that investors might want to put on a hedge and wait out the sidewave: http://www.edwards-magee.com/?p=5422

After we agonized we wondered if the light tone of our letter was not properly grim. Should we have set our hair on fire and started screaming that the sky was about to fall? Well, just not our style, but readers should be aware that nothing we say is casual or unconsidered. It’s like when critics asked El Vitti, the Spanish matador, why he never smiled in the bullring: Hombre, este es asunto serio y tragico. (Man, this is serious and sometimes tragic business.)

Well, post mortems under the bridge. The present situation. The New High stop is broken. 1995.23. if one were running his portfolio on this stop he should 100% hedge or sell. Discipline is discipline. If using the wave low stop he should be ready to bail at 1947.81.

What do we think? We think the contrarians will be covering their shorts Monday, and that there will we a b wave bounce. In spite of all the negative phenomena and the chicken littles looking for attention we don’t think, so far, that this is a major bear market. Don’t hang up. We could change out opinion Monday.

Remember. You can change your mind and positions with the click of a mouse. There is nothing the matter with being wrong. What is destructive is refusing to admit it and hanging on to it.