http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p38955316076&a=266398464

The law of gravity in the market is a little counterintuitive. It says that stocks rise over the long run. Simple as that. Dec 24 Jason Sweig wrote a column in the WSJ on how John Bogle looks at the market: titled, The Simple Best Way to Predict the Market. The logic and reasoning of Bogle’s philosophy are absolutely inassailable and accurately describe reality as we know it.

We are not going to completely describe Bogle’s method here. A concise description is possible. Bogle says that only three factors are necessary to predict future returns: Dividends; Earnings Growth; and Speculative Return (or, how much investors are willing to pay for stocks (measurable by the price /earnings ratio).

Simplicity is of the utmost, to Bogle and to us. Where we part company with Bogle is in believing that performance can be improved by not continuing to hold issues which have reversed trend and are declining. But then, we have a tool Bogle evidently does not possess: the trendline. We don’t know if Bogle held on to his stocks in 2008-09. (His philosophy implies he did.) We didn’t. And won’t the next time.

So much for that. Worth reading.

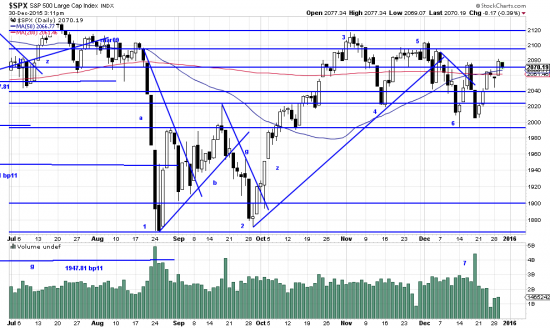

There is no change in the market: sideways with a slight downward cast. We closed our hedge and put on an inoffensive little position in the UPRO. We think intelligent and prudent investors are watching football right now and not trading.

Happy New Year!