The most damaging thing you can do to your portfolio equity is to build a case –or try to build a case– for your market opinion. A short and efficient road to ruin. So we always check out reasonable bear market scenarios (being as some accuse us of being permabulls) (An investment posture which has done nothing but rain profits down on us since mar09.)

Here is what our research on the question has turned up:

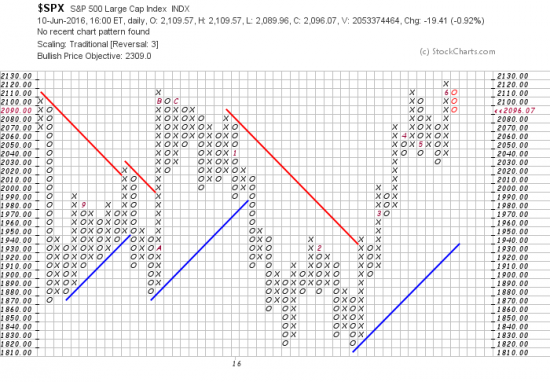

http://stockcharts.com/freecharts/pnf.php?c=%24SPX,PWTADANRBO[PA][D][F1!3!!!2!20]

PnF system still targeting 2309.

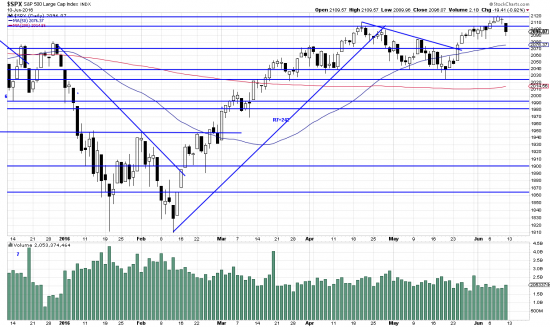

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p70142979615&a=266398464

This is not a picture of a market which is going in the tank any minute — regardless of what the famous palindrome does (lay on a huge short).

As tops form, component parts of the ETF degenerate: Here is the technical composition of the SPX:

This is the percentage of members of the S&P 500 which are above their 50 day moving average.

http://stockcharts.com/h-sc/ui?s=%24SPXA50R&p=D&yr=0&mn=6&dy=0&id=p48487122869

62% of stocks in the index healthy.

Chicken Littles to the contrary notwithstanding we don’t see a cliff here.