But nothing like what just hit David Cameron in the head… When those pesky peasants revolt it creates all kind of problems for Oxbridge elites. Thank god we don’t have problems like that here (not counting Trumps trumpkins…

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p70142979615&a=266398464

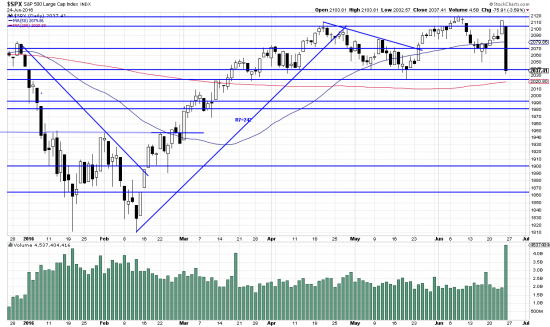

The two days of Brexit produced turmoil like a Japanese tsunami. Pound down 10%, Dow down 610 points. SPX futures limit move down 100 points. But by our reading this vigorous assault didn’t even produce a breakout of the sideways trend. Though it certainly poked a hole in the bottom of the boat — and probably made a small killing for that old palindrome Soros.

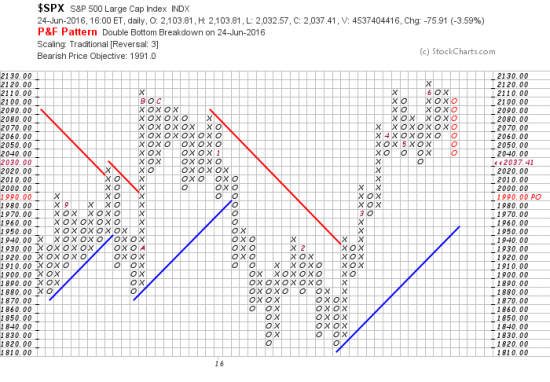

We took a shot at catching the bottom and were rapidly dissuaded. Now we will watch closely to see what develops and then take another shot. We took a look at the formation and made an effort to analyze how far this piece of Chicken Little work might go. Here is the PnF chart:

http://stockcharts.com/freecharts/pnf.php?c=%24SPX,PWTADANRRO[PA][D][F1!3!!!2!20]

The PnF system looks for a target of 1991. Interestingly, if you just do an old fashioned E&M calculation you get a target of 1930, based on the depth of the formation. Running a rule of seven analysis may be previous, based on a one bar move, but it does yield targets of 2007, 1980 and 1935. Rule of seven explained at http://www.edwards-magee.com/ggu/ruleofseven.pdf.

As we noted analyzing one bar waves is a fool’s occupation, but since the Brexit vote made fools of us all, why not. We often look at volatility explosions like this as a trend starter. That may be true — and at the very least waiting to see if this is a falling knife or a buying opportunity is in order.