http://stockcharts.com/h-sc/ui?s=SLV&p=D&yr=0&mn=6&dy=0&id=p94735009296&a=455395444

Good news or bad news? Or no more news? Silver breaks out — but it is now maybe, too hot to touch. It has gone parabolic, and you know what happens when an issue has gone parabolic. In general they collapse and burn late buyers. We will be watching silver this week to see whether to add-on or exit. You can always buy and take your chances — but you must stop it up tightly and watch it closely. Of technical interest silver had three gaps before breaking out. Then it had a breakaway gap and then a runaway gap — and went parabolic.

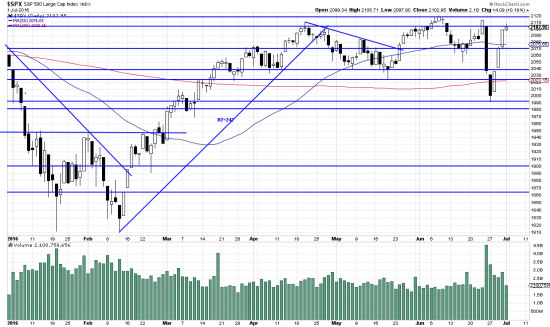

Presenting us with the question — to buy or to watch. SPX prsented us with a crucial question also. After tanking with the Brexit SPX turned and ate the shorts’ lunch. And their breakfast and their dinner. Sufficiently that this sell off may not be subject to the a-b-c (or alpha-beta-gamma) analysis (http://edwards-magee.com/ggu/alphabetazetawaves.pdf ) and may have no revelance here. But we don’t know that yet — that is — are we in a b wave and will prices test the recent low with a c wave, or is this a v bottom.(?)

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p70142979615&a=266398464

We regard silver and gold as knee jerk reactions to the Brexit volatility and not as genuine issues operating on their own. We may be overly cynical in this instance but given the alternate universe we are living in with British politicians falling on their swords and American politicians not falling on their swords (O If only!) maybe not. This purgative may satisfy the market’s need for drama and deck cleaning and we should know fairly soon if we can get on with the bull market.