http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p70142979615&a=266398464

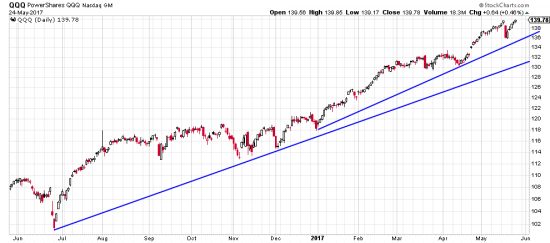

A few days after an ugly air pocket the SPX wesnt to a new high. That’s not the important fact here. The important fact is that over the recent past there is a pattern which keeps repeating intraday: the SPX gets hammered but by the end of day the index has recovered. Ergo: sosmeone is stepping in to buy a down index. Jungle drums have said the public is nibbling, but this looks more organized. Based on this pattern we added to our QQQ position the day after the sell off.

http://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=1&mn=0&dy=0&id=p14374245879&a=525339166

Not a bad idea perhaps. QQQ seems to have more oomph than the SPX. And less stuttering.

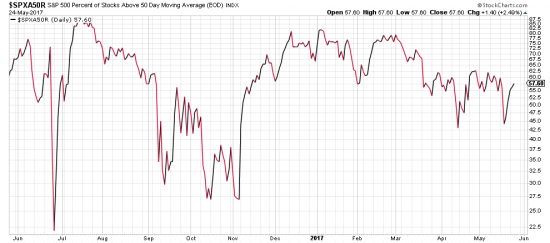

We have been dismissive of the Chicken Littles running around worrying about the sky. They are always clucking at new highs. But the secret Magee oscillator is not supportive of a market break. The Magee Evaluative Index was developed by Magee to aid in calling turns in the market. Here is how it works: Magee observed that when 80 percent of stocks were strong there was a good chance of a turnaround so a sell was indicated. When 8% of stocks were strong a buy was indicated. This procedure is described in the 10th edition (and probably others) of Technical Analysis of Stock Trends. Here is a chart showing percent at present.

Presently at 57% This is a crude expression of Magee’s procedure but good enough for government work. Especially this government.

http://stockcharts.com/h-sc/ui?s=%24SPXA50R&p=D&yr=1&mn=0&dy=0&id=p56594529159