As readers know, we sternly inveigh against rash speculation, gambling and other forms of non-Lutheran fun. Prudent readers should just be content to beat the market with the indices and ETFs and tut-tut as Enron speculators and oil gamblers go down.

As readers know, we sternly inveigh against rash speculation, gambling and other forms of non-Lutheran fun. Prudent readers should just be content to beat the market with the indices and ETFs and tut-tut as Enron speculators and oil gamblers go down.

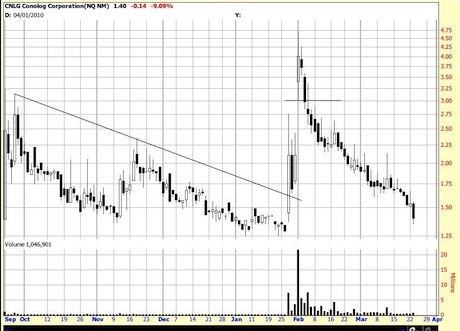

Our evil twin Karnak, on the other hand loves the click of the dice and the ruffle of the cards. So he loves issues like CNLG. Unfortunately there is not a trade here at the moment, only a lesson. The lesson is that of the “bull trap — snap”.

In late January there was a pefectly valid buy signal on a power bar. What you do is buy 2 units (100 share units or 1000 or 10000 –whatever your unit is) as you see the bar developing. Your stop is the low of the bar, and you can also watch closely day 2. You evaluate that bar. An ugly power bar down would liquidate part or all of your trade. You expect a black bar. Day 3 in this case is positive. Day 4 is cash in day. You sell one unit (you’re supposed to do this on the high of the day — you better be watching the 30 minute bars). Day 5 is not encouraging, but more or less neutral. But day 6 is the trap snapping shut and you sell your other unit and you have a terrific short.

Now Karnak (see picture) loves to be invited to poker parties like this. If you see one developing email him toot sweet and he’ll hot foot it to the party with his dark aviator glasses and his Texas Longhorn ball cap.

Meanwhile, back at the ranch, AIG and C (at least) looked like they might be setting up flags.

Doesn’t this qualify as a bull trap–snap? If we were long we certainly would have a stop 3 or 4% under the low of the second power bar. And if we saw a break out of the down drift here we would be putting on another unit. AIG? Stranger things have happened.