Gray-bearded traders will remember (if they haven’t been overtaken Alzheimer’s) Peggy Lee and her disillusioned song, Is That All There Is? Which sort of encapsulates our reaction to the 4 day wavelet we (perhaps) saw end Friday. Is that it? Where is the double dip, the purging of the wicked and the return of fire and brimstone? The lack of follow-through makes us think that that’s all there is. On the other hand, paranoia is often one of the valued characteristics of an investor/trader. In general we are probably much more inclined to take trades in apparently risky situations because we determine how much to risk and are always willing to terminate a trade when that point is hit. The favorable thing about the downwavelet is that the talking heads can now stop harping about the 60 day wave. We can start a new one. Which we expect.

Gray-bearded traders will remember (if they haven’t been overtaken Alzheimer’s) Peggy Lee and her disillusioned song, Is That All There Is? Which sort of encapsulates our reaction to the 4 day wavelet we (perhaps) saw end Friday. Is that it? Where is the double dip, the purging of the wicked and the return of fire and brimstone? The lack of follow-through makes us think that that’s all there is. On the other hand, paranoia is often one of the valued characteristics of an investor/trader. In general we are probably much more inclined to take trades in apparently risky situations because we determine how much to risk and are always willing to terminate a trade when that point is hit. The favorable thing about the downwavelet is that the talking heads can now stop harping about the 60 day wave. We can start a new one. Which we expect.

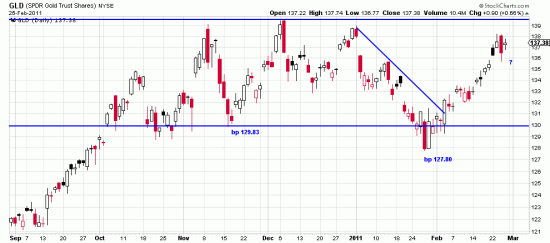

On the other hand in the precious metals some housekeeping is in order. In the gold here there are a couple of possible Basing Points: 11/16 129.83 and 1/27 127.80. 5% is probably a good filter. As for the last couple of days we have indicated that they present a conundrum with a question mark. We think this pattern should represent a change of direction, but Friday didn’t fit with Thursday. (Wasn’t there some kind of question about “Friday’s child?”) If trading, and not trending we would look to Monday’s action to tell us to, like the Arabs, fold our tents saddle our camels and steal away. These comments apply to SLV, silver, as well as gold.

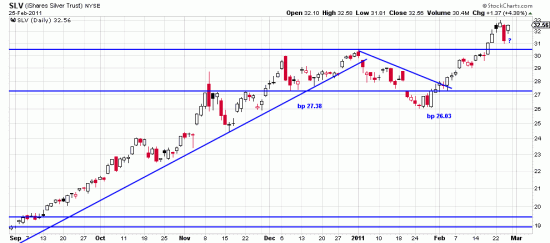

The Basing Point possibilities for SLV are very similar to gold: 12/10 27.38 and 1/25 26.03. The wave here is 22 days which may be long enough. We think both issues are essentially in unruly congestion trading patterns which make the likelihood of reversal here more likely.

The Basing Point possibilities for SLV are very similar to gold: 12/10 27.38 and 1/25 26.03. The wave here is 22 days which may be long enough. We think both issues are essentially in unruly congestion trading patterns which make the likelihood of reversal here more likely.

Remember. Hopping off these issues may save some short term irritation or pain but bearing up under downwaves and trading the long term trend always beats trading in the long run, except for geniuses — which we’re freshly out of around here.