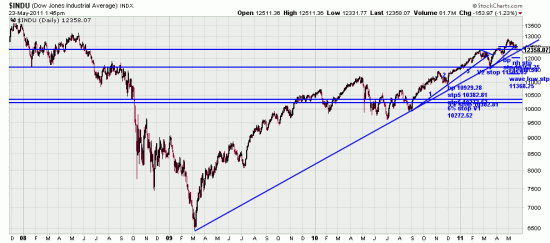

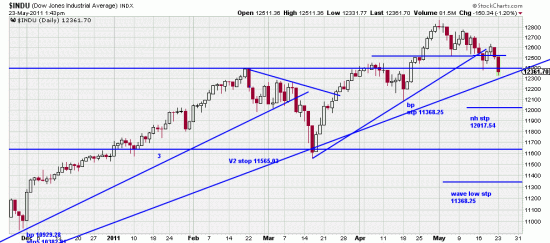

Here’s the long and the short of it. Top chart, market since March 09 showing the long term trendline. As we see in the lower chart the short term trendline is broken and price is flirting with the long term trendline. This is no casual flirtation. It is more like Dominique Straus-Kahn about to do violence to an unsuspecting market. (or very nervous market)

Here’s the long and the short of it. Top chart, market since March 09 showing the long term trendline. As we see in the lower chart the short term trendline is broken and price is flirting with the long term trendline. This is no casual flirtation. It is more like Dominique Straus-Kahn about to do violence to an unsuspecting market. (or very nervous market)

We have marked an alternate new high stop here 12017.54which is a perfectly respectable alternative to the deep wave low stop. We have been saying for awhile now that some hedging might be in order and looking at the chart we are even morre convinced of that. We had expected prices to maybe drift across the trendline — might be a swan dive instead — A BLACK SWAN DIVE. You knew that was coming. It is wit like this which is our bid for the Nobel for financial journalists and snarky economists.

Don’t worry. The Friedman guys have already sabotaged us in Stockholm. You thought they were hiding their heads in shame after being beaten in the top of the ninth by Keynes in 2009? No, hubris never gives up so easily.

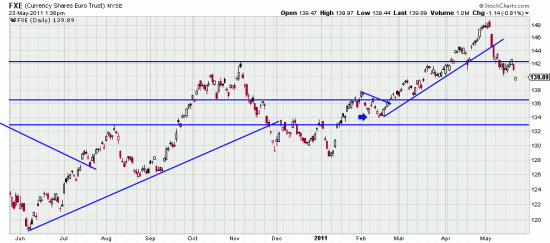

But enough of deep philosophizing. Look at the euro, which, hearing that the end of the world was nigh took a dive off the high board, and today is another sell signal, gap and all.

We’re already short via the EUO. Roger Tory Peterson called and asked us to write a blurb for his next book.

We’re already short via the EUO. Roger Tory Peterson called and asked us to write a blurb for his next book.