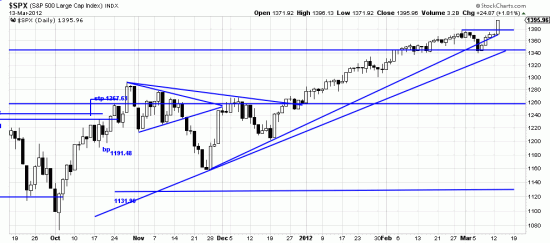

Sometimes the signals are like engraved invitations. Just as we were opening our mouths to say that the next thing to expect was expanded volatility it reared back and smacked us in the face. Since we are already long this is an add-on signal for us which we will be doing tomorrow. You can almost pick your poison here. The Dow, the Qs, the SPX — all were screaming buy me today.

Sometimes the signals are like engraved invitations. Just as we were opening our mouths to say that the next thing to expect was expanded volatility it reared back and smacked us in the face. Since we are already long this is an add-on signal for us which we will be doing tomorrow. You can almost pick your poison here. The Dow, the Qs, the SPX — all were screaming buy me today.

After about 20 days of ‘drift” comprising about 320 points in the Dow the lid blew off and we had a 1.81% day in the SPX and a 217 point day in the Dow. Now, interestingly, if you look at the VIX you will see it dropping through the floor, instead of doing what it really should be doing — measuring volatility. Volatility on the upside is ignored because of the idiosyncrasies of the VIX. Market up, VIX down. Market down, VIX up. Of interest the VIX closed at 14.80 today and there are some worrisome facets to that, since volatility reverts to the mean — but only when you have been lulled to sleep.

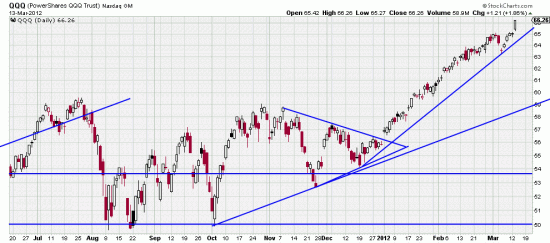

Here the Qs breaking away (with the pelonton in hot pursuit). These kinds of signals are what we consider the absolute best — raging power bars breaking to new highs in a clear uptrend.

Here the Qs breaking away (with the pelonton in hot pursuit). These kinds of signals are what we consider the absolute best — raging power bars breaking to new highs in a clear uptrend.

We will look at the volatility situation and the state of the trend a little later this week.

There are a lot of different versions of the book technical analysis of stock trends by edwards and magee. What versionor book is the most up to date? The 9th edition is the current book. A drive by pirate advertises a paperback on Amazon and we stamp him out occasionally but don’t be deceived. Sorry I didn’t see this note earlier.