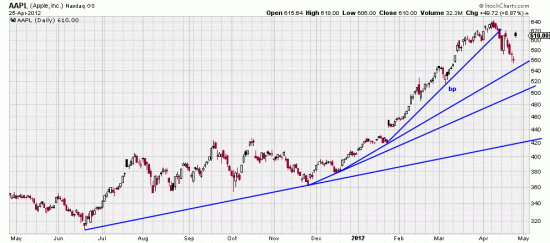

It didn’t take Apple long to justify our last letter. One day. The huge earnings gap stuck a finger in the eye to doubters, and the long term approach we advocated was instantly vindicated. The technical lesson here is that short extremely sloped trendlines have consequences appropriate to their length and slope. This doesn’t mean the turbulence is over in Apple, but it does emphasize the importance of prudent long term stops. For instance, look at the other trendlines in the stock.

It didn’t take Apple long to justify our last letter. One day. The huge earnings gap stuck a finger in the eye to doubters, and the long term approach we advocated was instantly vindicated. The technical lesson here is that short extremely sloped trendlines have consequences appropriate to their length and slope. This doesn’t mean the turbulence is over in Apple, but it does emphasize the importance of prudent long term stops. For instance, look at the other trendlines in the stock.

Note the last short downtrend line on the chart. Broken by yesterday’s strong day. We usually take this pattern — which is close to the alpha-beta-gamma-zeta pattern we have spoken of– as a reentry or add-on signal. Power bar across a trendline is almost always a good signal — (Now let us list twenty points as a caveat to this statement: context, state of market, volatility conditions, day of week, state of 4 year election cycle, proximity to Gann lines, Fibonacci number, Fed meetings, whether the Giants have a game or not… you get the idea.) It’s always different this time… In fact it was never the same. It was always different and only Dow Theory investors are fat sleek and sleep dreamlessly at night

Note the last short downtrend line on the chart. Broken by yesterday’s strong day. We usually take this pattern — which is close to the alpha-beta-gamma-zeta pattern we have spoken of– as a reentry or add-on signal. Power bar across a trendline is almost always a good signal — (Now let us list twenty points as a caveat to this statement: context, state of market, volatility conditions, day of week, state of 4 year election cycle, proximity to Gann lines, Fibonacci number, Fed meetings, whether the Giants have a game or not… you get the idea.) It’s always different this time… In fact it was never the same. It was always different and only Dow Theory investors are fat sleek and sleep dreamlessly at night