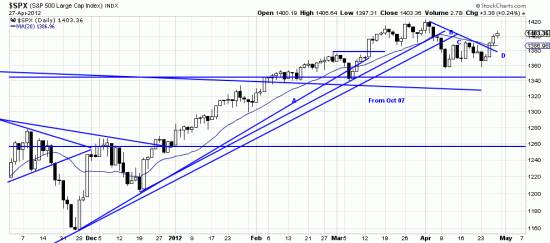

The entire chart is a reminder of where we came from — the broken trendlines from October — and also the broken long term downtrend line from 07. Trendline D, the last short term downtrend line is the star of the piece we often call the alpha-beta–gamma–zeta wave –except there was no gamma (or C) wave. It appears that the little consolidation here may have taken the place of that wavelet. Remembering always that sidewaves can take the place of up or down waves. Last week’s action was constructive as is the breaking of the D line. This pattern was repeated in many indices and stocks.

The entire chart is a reminder of where we came from — the broken trendlines from October — and also the broken long term downtrend line from 07. Trendline D, the last short term downtrend line is the star of the piece we often call the alpha-beta–gamma–zeta wave –except there was no gamma (or C) wave. It appears that the little consolidation here may have taken the place of that wavelet. Remembering always that sidewaves can take the place of up or down waves. Last week’s action was constructive as is the breaking of the D line. This pattern was repeated in many indices and stocks.

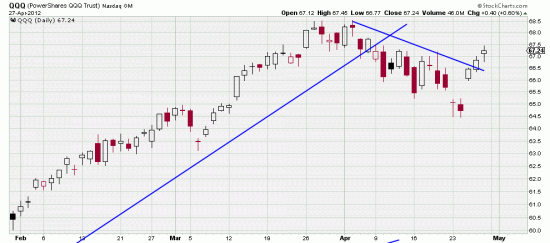

Here it occurs in the QQQ — with the added fillip of an island reversal. All the signals here in the Qs say buy me, and so we did buy some by lifting our hedge. We are somewhat concerned by the outsize influence of Apple on the Qs. On the other hand, if Apple goes to 1000….

Here it occurs in the QQQ — with the added fillip of an island reversal. All the signals here in the Qs say buy me, and so we did buy some by lifting our hedge. We are somewhat concerned by the outsize influence of Apple on the Qs. On the other hand, if Apple goes to 1000….

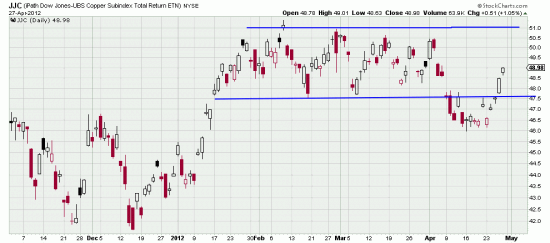

Other signs of spring springing are in that bellwether metal, copper.

Here we have more buy signals — and an unusual 1 day island reversal embedded in a thirteen day island reversal. We will be buying some copper this week.

Here we have more buy signals — and an unusual 1 day island reversal embedded in a thirteen day island reversal. We will be buying some copper this week.

Meanwhile, back at the naked mud wrestling pit –it appears that the big guys (big enough to move the market for at least a few minutes) are working overtime at short term trading –extreme volatility over 2 to 15 minute periods, rocket moves up followed by roller coaster like plunges. All the earmarks of monkey business (unfortunately, not illegal.) There is no way the non-professional investor or trader can compete with these guys –or rather, there is no way to compete on their terms. It is totally feasible to out smart them over the long run — by using the long term trend following methods espoused by this letter.

Enjoy watching the snakes bite each other to death and keep your stocks well away that pit.