http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p83257770514&a=266398464

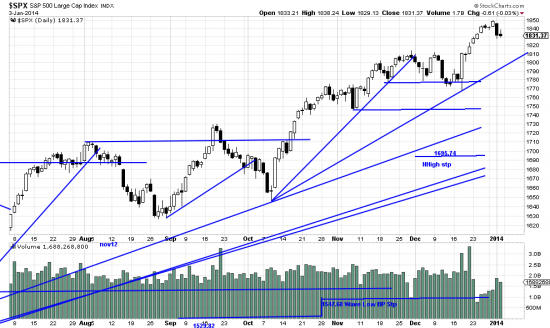

The real traders returned from vacation and observing — as we did last week — that the market was vulnerable gleefully hammered it, transversing a range of 18 SPX points on good volume. Then the next day snow fell on New York and dampened their enthusiasm. This means we will have to wait until next week to see if there is followthrough. We were hedged which we did on the close Friday and could have take a scalp, but we’re waiting to see how the market feels about having the smart guys back.

Otherwise to this point we see no change in market conditions and mood. Money has poured into mutual funds and hedge funds like snow falling on New York and that kind of buying strength will not be easily stemmed. Will the market see — as some pundites suggest — an 8-10% year on top of the booming 24-5% of ’13 Who knows. But you don’t need to know to maintain your long portfolio.

We put so more capital in the market (UPRO) over the Holiday, but we won’t be dong more until the new year sorts itself out.