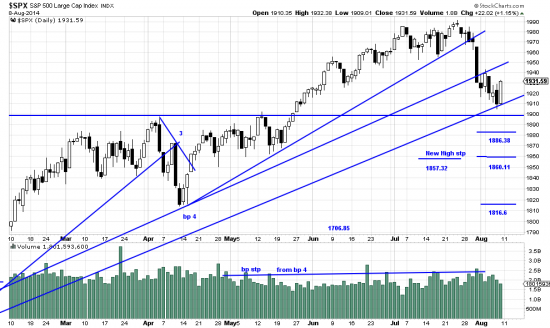

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p83257770514&a=266398464

Frequently it falls to us to explain what it all means — usually a role we can fulfill,, as we just interpret the chart. What Friday means is that a lot of bears (and a few bulls) jumped on the market when the Russians signaled that they weren’t going to invade Ukraine (i.e. short covering). In fact it’s a wonder that there was room enough for everybody on the bandwagon. But the underlying message is that there are a lot more votes for the bull side than for the bear side. The underlying message underlying the underlying message is that this is a deep and powerful bull market which is not done yet.

The opera is not over till the fat lady sings, and the market is not over till the lambs come back to form a top and get roasted. As for the present formation we read it as a potential alpha-beta-gamma formation still in its a wave, though Friday may be the start of a b wave. Also it would astonish us if this is all the reaction we get from the breaking of a 20+ month trendline. Were that the case it would be an even more powerful vote for an intransigent bull market.

Based on the trendline break we scaled out of some of our SPX positions and are now more or less fully hedged with SPXU. (Not an instrument we like, actually.) Also, next week we will be out of touch from the market, hunting trout in the Sierras, but will check in during the week to make certain it does not get irrational. (More irrational?)