http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p99378568549&a=266398464

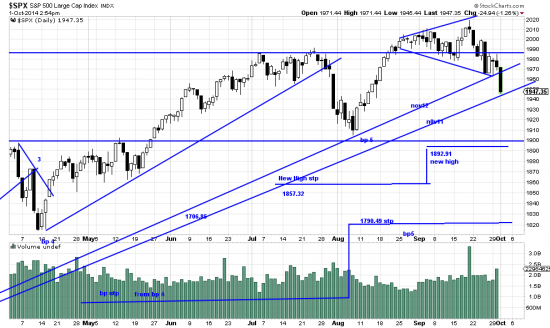

The market is telling us to get serious. Sailing leisurely over a great bull market is pleasant business. But when you hit the Bermuda triangle you have to get serious. In short you have to reef the sails and get ready for rough weather. The nov12 trendline is broken and price is sitting right on the nov11 trendline. Let us review some technical precepts. A trendline break becomes valid when it is confirmed. Magee saw confirmation when the penetration reached 3%. Some technicians would see confirmation on three closes below the line. A power bar here might constitute confirmation. A confirmed break has serious implications.

Confirmed or not serious business is at hand. It seems clear to us that some major players are rearranging their portfolios in fear of rising interest rates. (As well as ISSL, China, Europe, Argentina, Turkey, Afghanistan, Hong Kong, Bill Gross and Lady Gaga.) We see this as a temporary squall, but it can easily get out of hand. Though it may be temporary we have done some serious hedging and cut back on our UPRO positions which are fun when the market is surging and painful (3x) when storms hit.

The massive power of this bull market and the presence of itchy money on the sidelines (itching to get in) should ameliorate a downwave here, but only price and time will tell.

Here is a long term look at the S&P.

http://stockcharts.com/h-sc/ui?s=$SPX&p=W&yr=5&mn=0&dy=0&id=p76786886174&a=365517009

This wave which dates from november 11 is obviously powerful and the trendlines are very important.

Hedging can be done with (leveraged) SPXU, SPXS, (unleveraged) TOTS. More sophisticated (beware of sophistication) readers can check out the CBOE site for portfoliohedging http://www.cboe.com/portfoliohedge. It would be wise to consult an experienced broker before plunging into options, but it is an effective way to hedge.

In all probability readers who sit through all this unless and until the systems stops are hit will wind up laughing last and best.