The Bible according to Hank Pruden |

THE FOUNDATION UPON WHICH TECHNICAL ANALYSIS IS BUILT.

"#1 all time classic, considered to be the best book on chart patterns ever written." Ed Dobson, Traders Press, Inc. A six month subscription to this site is included with TAST 8 bought from this site. To read more about and to buy, see TAST 8. Accept no substitutes. |

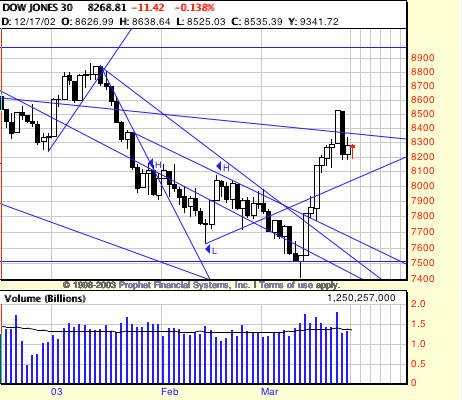

Trading Tactics: Running Market: Buy Strength, Sell StrengthLessons from the War FrontMarch 27 2003The market situation: Prior to March 19 2003 the market drifted lower waiting for King George II to pull the trigger for war in Iraq. On Wednesday (19) of the week the insiders got the start date and ran the markets up Wednesday Thursday and Friday and spooked the shorts who helped them run it up. Wednesday saw two significant events: a key reversal day and the break of a 7 day downtrend. Thursday was a solid white candle, no shadows. &* the Air Force tried to catch Saddam napping which it almost did. Unfortunately he was napping next door to the bunker the Air Force took out. But for a couple of days it looked like we had killed the fox in his lair. Happy markets. Monday thorough Friday the market continued to run with trader confidence running high and shorts running fast, and Washington running off at the mouth. Friday was a barn burner. Any trader who held his position over the weekend deserves what he got. Beaten up badly. Over the weekend reality set in, as it will tend to do. And Monday the bears ate the bulls without bothering to cook them first. What did you expect?

The situation Friday at the close.

The situation the next Wednesday before the close. The tactical situation: Market drifting lower waiting for news. Should be short or out. Short on the technicals. Out on the possibility (probability) of news. The signal: Key reversal day in explosive news environment. The second signal. Run day on volume, breaking 7 day trend line. Liquidate shorts and get long. Stop: nearest low. Thurs and Friday market runs. Trader watches tape. Friday: Decision point. Old Traders exit on close. Bold traders evaluate quality of news and market emotion. Might stay long. Monday everybody is long. Market runs through Friday. Old and bold traders out on close Friday. How did they do that? Why didn't they get out Wednesday, or Thursday? Because each day they utilized the Magee Tight Stop rule. Each day move the stop up to the low of the previous day. Friday the market has moved too far too fast. The news environment is explosive. A Reaction is 100% certain and unlike during the week a reaction can't be dealt with by liquidating on weakness (the previous day's low). Sell the strength Friday. Watch the news develop over the weekend and Monday morning get short (if there is a chance) and cut the ears off the bulls. The gap down on the opening Monday was a clear signal. |

|

Events Listing

2 1/2 DAY SEMINAR

TECHNICAL ANALYSIS OF STOCK TRENDS

Being Scheduled as of 3/03

KKKK

Kiss and Kry and Kibitz with Karnak

Tent: Thurs April 3 2003

3 to 5 pm

One Day Total Immersion Workshop

in April. Intensive and rigorous drill

in natural trading methodology

FI498S

Golden Gate University Graduate Seminar

Building Effective Trading Systems

May to August